What Does Summitpath Llp Do?

What Does Summitpath Llp Do?

Blog Article

Not known Details About Summitpath Llp

Table of ContentsNot known Details About Summitpath Llp Some Ideas on Summitpath Llp You Need To KnowThe Summitpath Llp DiariesAbout Summitpath Llp

Most recently, released the CAS 2.0 Method Growth Training Program. https://342111299.hs-sites-na3.com/blog/summitp4th. The multi-step coaching program consists of: Pre-coaching placement Interactive group sessions Roundtable conversations Individualized mentoring Action-oriented mini plans Companies looking to expand into advisory solutions can additionally transform to Thomson Reuters Method Ahead. This market-proven methodology offers web content, tools, and advice for companies curious about consultatory servicesWhile the adjustments have actually opened a number of growth possibilities, they have additionally resulted in obstacles and concerns that today's firms need to have on their radars., companies have to have the capability to promptly and efficiently perform tax study and improve tax reporting effectiveness.

In enhancement, the new disclosures may bring about an increase in non-GAAP actions, traditionally an issue that is very looked at by the SEC." Accounting professionals have a great deal on their plate from regulatory changes, to reimagined company designs, to a boost in customer expectations. Equaling all of it can be challenging, yet it doesn't need to be.

Unknown Facts About Summitpath Llp

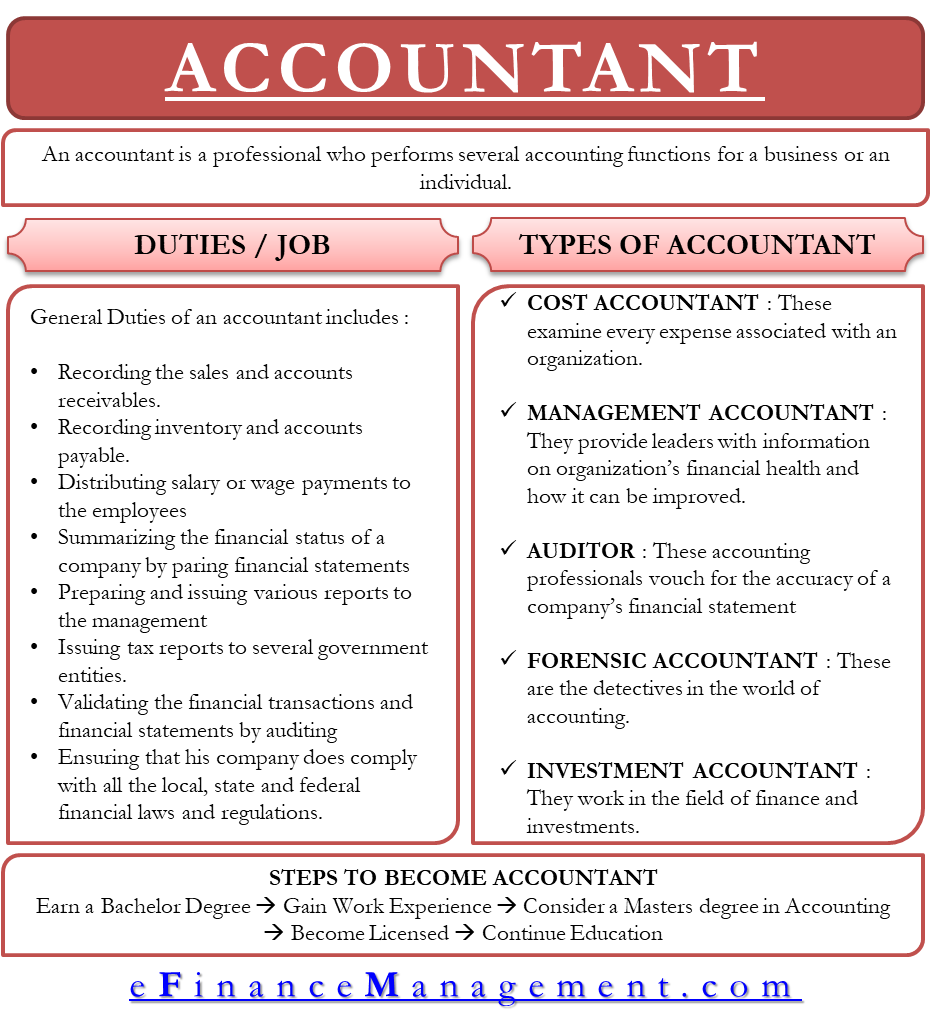

Listed below, we explain four certified public accountant specialties: taxes, management accounting, monetary reporting, and forensic bookkeeping. Certified public accountants concentrating on taxes help their clients prepare and file income tax return, reduce their tax concern, and avoid making errors that might bring about costly charges. All Certified public accountants require some understanding of tax obligation legislation, but focusing on taxes suggests this will certainly be the focus of your job.

Forensic accounting professionals typically begin as general accountants and relocate right into forensic accounting duties over time. CPAs who specialize in forensic audit can in some cases move up into administration accounting.

No states need a graduate degree in accountancy., bookkeeping, and taxation.

And I suched as that there are great deals of different task choices which I would certainly not be jobless after graduation. Accounting also makes functional feeling to me; it's not just academic. I like that the debits always need to amount to the credit scores, and the annual report needs to stabilize. The CPA is an important credential to me, and I still get proceeding education credit reports yearly to stay on top of our state demands.

The Definitive Guide for Summitpath Llp

As a self-employed professional, I still utilize all the standard foundation of bookkeeping that I learned in college, seeking my certified public accountant, and operating in public accountancy. Among the points I really like regarding accountancy is that there are several different tasks offered. I decided that I wished to start my profession in public accounting in order to find out a whole lot in a brief time period and be revealed to various kinds of customers and different locations of accounting.

"There are some offices that don't intend to think about a person for a bookkeeping role who is not a CPA." Jeanie Gorlovsky-Schepp, CPA A CPA is a very beneficial credential, and I intended to place myself well in the marketplace for various jobs - tax preparation services. I decided in university as an audit major that I intended to try to get my CPA as quickly as I could

I have actually met a lot of fantastic accountants that don't have a CPA, but in my experience, having the credential actually aids to promote your knowledge and makes a distinction in your compensation and profession alternatives. There are some work environments that do not intend to take into consideration someone for an accountancy function who is not a CERTIFIED PUBLIC ACCOUNTANT.

Excitement About Summitpath Llp

I actually enjoyed servicing different types of projects with different customers. I found out a lot from each you can find out more of my coworkers and clients. I collaborated with various not-for-profit organizations and located that I have a passion for mission-driven organizations. In 2021, I determined to take the following action in my bookkeeping occupation journey, and I am now a freelance bookkeeping specialist and business advisor.

It continues to be a development area for me. One important quality in being an effective certified public accountant is genuinely caring concerning your customers and their services. I love working with not-for-profit customers for that really reason I feel like I'm really adding to their objective by assisting them have great financial information on which to make wise organization choices.

Report this page